UK company Frontier Developments Ltd announced August 7 its plan to open a new game development studio in Halifax.

The announcement rewards Nova Scotia’s “Your Studio Belongs Here” campaign, an initiative to entice game studios into relocating or expanding into the area. The campaign boasts lower living costs which deliver better bang for buck, “better than the U.K, better than Montreal.”

Nova Scotia’s incentive programs include a performance-based rebate generally amounting to 5-10 percent of payroll, the federal SR&ED program plus 15 percent provincial R&D credits, and a digital media tax credit offering the lesser of 50 percent of qualifying expenditures or 25 percent of total expenditures. The average traditional console game consumes $10,083,000 in development, equating to at least $2,500,000 through the digital media tax credit program.

A lower refund rate offered for digital media producers in British Columbia could be responsible for a reallocation of resources by major west coast game dev studios, including Activision and Rockstar. B.C. offers a refundable credit worth 17.5 percent of qualifying expenditures, equating to a refund of less than half that offered by N.S.

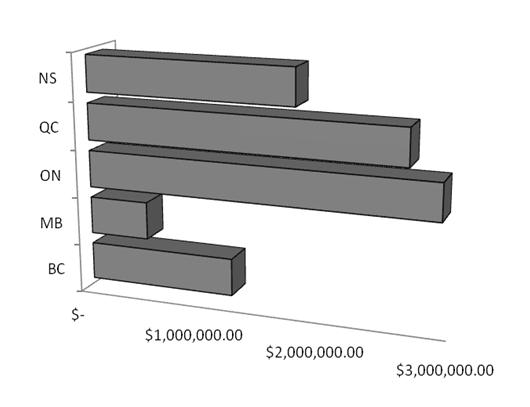

Here is a rough comparison of the worth of digital media tax credits by province, based on a $10,083,000 development cost and a marketing spend of $200,000. Eligible labour has been generously estimated at 70 percent of development costs.

Manitoba falls short in this example with a cap of $500,000, but still offers a competitive rate of 40 percent which benefits lower development cost projects, including casual or mobile platform games with an average spend between $166,000 and $442,000.