Canadian stocks are soaring, while the economy is expected to reach slowest pace in a decade.

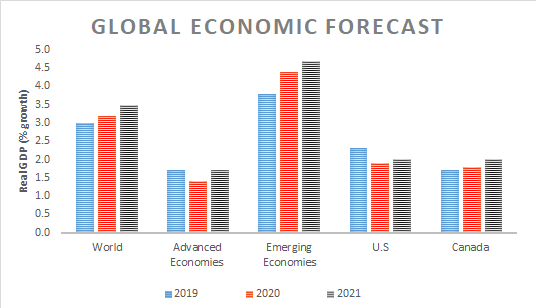

The National Bank of Canada reports investor optimism for a pro-growth agenda on the horizon at the end of 2019, despite the effects of recent protectionist policies continuing to ripple across global supply chains. The fate of emerging markets, in particular, therefore continues to linger on investor sentiment for the U.S. and China trade deal.

Investor confidence in the U.S. – China trade war de-escalating sent the MSCI All-Country World index soaring to an all-time high in November amid positive negotiations. U.S. venture funding remains high, with record levels of U.S-backed unicorns (180 total with aggregate valuation of $621.2B) as Internet, Healthcare and Mobile/ Telecommunications companies continue to dominate deal activity.

However, trade tensions are slowing economic growth with global trade volumes continuing to decline on a year-over-year basis and the manufacturing sector continuing to struggle. Global trade policy uncertainty is forecasted to persist longer than expected, according to the OECD’s November 2019 Economic Outlook, with imports and exports to remain subdued.

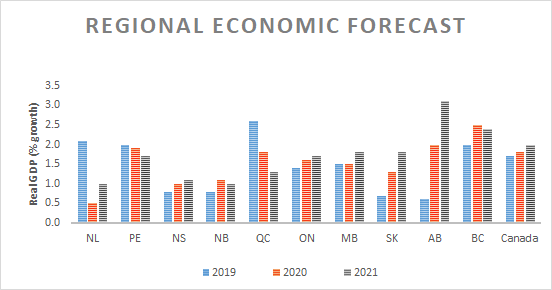

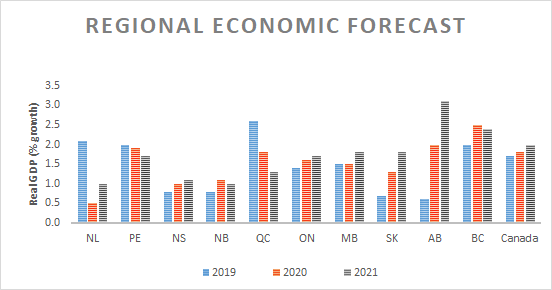

Rebounding from a low Q2, the Canadian economy was bolstered by increased growth in Q3 with newly revised GDP data on track to increase 1.7% in 2019 and 1.8% in 2020 according to the Bank of Canada.

Capital stock growth reached a four-year high as the net stock of capital climbed 1.2% in 2018 with gains in Ontario, Quebec, and BC offsetting declines in Alberta. Ontario saw increased capital stock across all industries including the first net capital stock increase in the manufacturing sector since 1999.

The Canadian economy is projected to reach full labour force and production capacity in 2020 after having operated below full capacity over the last several years.

Source: National Bank of Canada – Monthly Economic Monitor. December 2019